America’s more than 1,200 megachurches typically dominate religion news. Many of them boast large budgets and can afford generous retirement plans for their pastors and employees. But they’re only a small …

No Comment

Keep Calm and Carry On, Part II

December 7, 2020

Back in March, Timothy Plan ran a blog article called “Keep Calm and Carry On,” addressing the COVID-19 pandemic and what investors might expect. We’re still in the midst of …

Pro-Life Women Bring New Life to Congress

December 4, 2020

Regardless of how the presidential contest is eventually settled, pro-life women stunned observers by gaining substantially in the November national elections for Congress. With Young Kim and Michelle Steele now declared …

Timothy Plan employees join with Samaritan’s Purse to spread holiday cheer by filling shoeboxes for Operation Christmas Child

December 3, 2020

It’s been called the “6 handshakes rule”, also known as the 6 degrees of separation theory, which claims that we can get to know anyone by connecting through 6 people …

Still Thankful In An Imperfect World

November 25, 2020

As I've searched scripture, I've discovered that every house that Jesus ever went into, He made a difference in that house. He went to Simon the leper's house and that's …

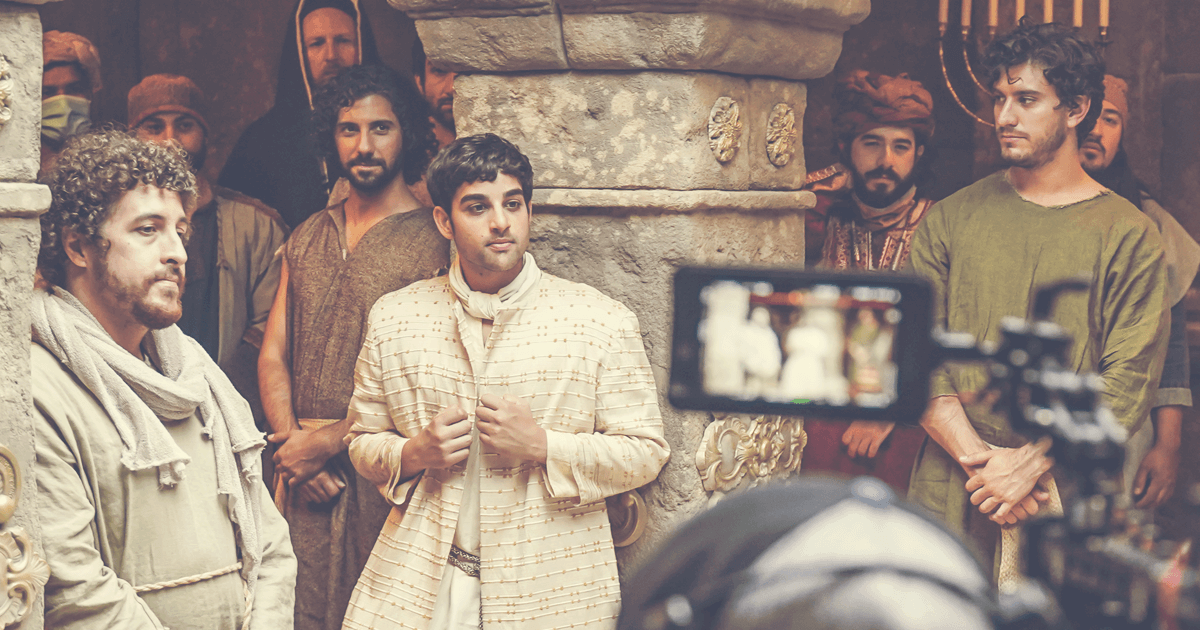

‘The Chosen’ Hits Goal of Fully Funding Second Season; Begins Filming

November 12, 2020

Production has begun on the second season of 'The Chosen,' which began filming on October 9 in Goshen, Utah. Costing more than $1,120,000 per episode, “The Chosen” is a high-quality telling …

Pain With A Purpose

November 4, 2020

May I suggest to you that God never wastes pain. When one examines the Old Testament, one clearly comes to know that the Old Testament has 39 books; 5 books of …

Smoking Out the Truth about Tobacco

October 27, 2020

Tobacco has been a marketable commodity in America for more than 500 years. In that time, the big-leafed weed has become an economic powerhouse, but the damage it has caused is …

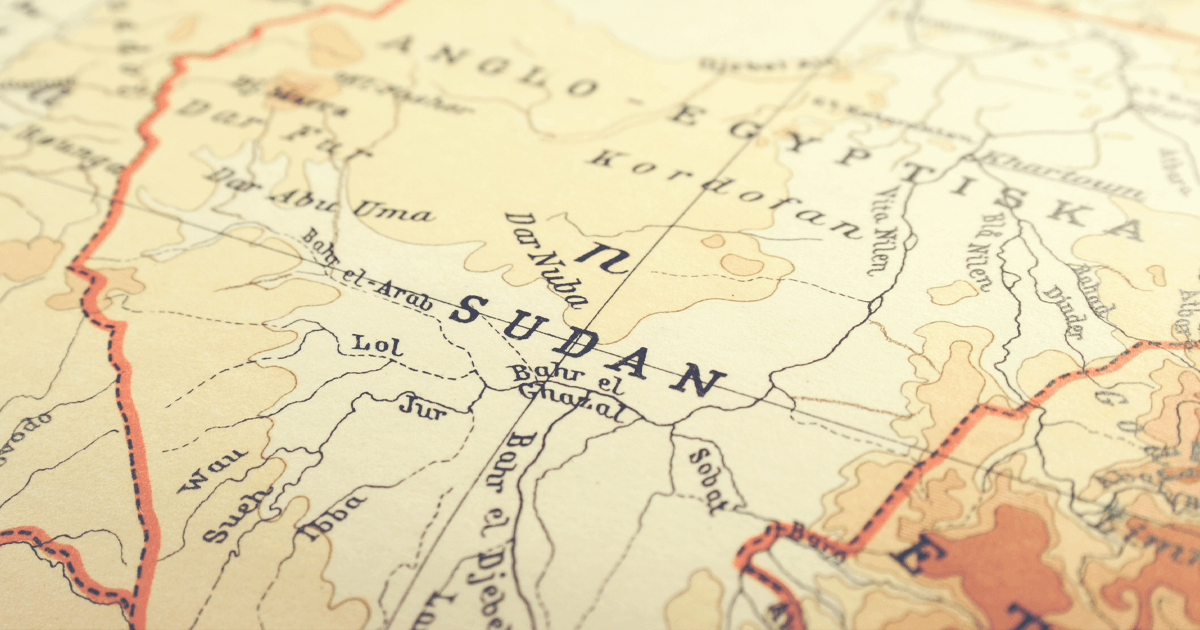

Sudan’s Move Toward Religious Liberty Bucks the Trend of Growing Persecution of Christians

October 20, 2020

In a major move toward religious liberty in Africa, the government in Sudan has declared an end to official enforcement of Islamic Sharia Law. This means that people will no …

A Heartening Pushback against Porn Purveyors

October 7, 2020

Two fast-growing petition drives and a request for a federal investigation indicate that more Americans are waking to the threat posed by pornography and are willing to speak up about …

-

Recent Posts

A Businessman Who Really Did Give it All Over to GodSeptember 28, 2022

A Businessman Who Really Did Give it All Over to GodSeptember 28, 2022 A ‘Screwtape’ Approach to Keeping Christians from Biblically Responsible InvestingSeptember 21, 2022

A ‘Screwtape’ Approach to Keeping Christians from Biblically Responsible InvestingSeptember 21, 2022 Both Inflation and Inaction Are UnbiblicalSeptember 14, 2022

Both Inflation and Inaction Are UnbiblicalSeptember 14, 2022

Categories

Archives

Instagram

-

[fts_twitter twitter_name=timothyplan tweets_count=1 cover_photo=no stats_bar=no show_retweets=no show_replies=no loadmore=autoscroll loadmore_count=5 loadmore_btn_maxwidth=300px loadmore_btn_margin=10px]

Investing involves risk, including the potential loss of principal.

Before investing, carefully consider the fund’s investment objectives, risks, charges, and expenses of the investment company. This and other important information can be found in the fund’s prospectus. To obtain a copy, visit TIMOTHYPLAN.COM or call 800.846.7526. Read each prospectus carefully before investing.

Because the Timothy Plan Funds do not invest in excluded securities, the Funds may be riskier than other funds that invest in a broader array of securities. There are risks when a fund limits its investments to particular sized companies, and all companies are subject to market risk. The Fund recently experienced significant negative short-term performance due to market volatility associated with the Covid-19 pandemic.

MUTUAL FUND INVESTOR

To read more about our mutual funds, please click this link to access fund information, including the prospectus, fact sheets, performance, and holdings for each fund.A prospectus is available from the Fund or your financial professional that contains more complete, important information. Please read it carefully before investing. Mutual Funds distributed by Timothy Partners, Ltd. Member FINRA.

HEADQUARTERS: 1055 Maitland Center Commons, Maitland, FL

(800) 846-7526 | Send an email | View our mapMUTUAL FUND SHAREHOLDER SERVICES: c/o Ultimus Fund Solutions, Post Office Box 541150, Omaha, NE 68154-1150

(800) 662-0201 | Account AccessETF INVESTOR

To read more about our ETFs, please click this link to access fund information, including fact sheets, performance and holdings for each fund. A prospectus is available from the Fund or your financial professional that contains more complete, important information. Please read it carefully before investing. ETFs distributed by Foreside Fund Services, LLC, Member FINRA. Timothy Partners, Ltd. is not affiliated with Foreside Fund Services, LLC.

ETF SHAREHOLDER SERVICES: Contact your financial advisor for information regarding your account.