Large/Mid Growth 3Q18

November 12, 2018

Recent Posts

- A Businessman Who Really Did Give it All Over to GodSeptember 28, 2022

- A 'Screwtape' Approach to Keeping Christians from Biblically Responsible InvestingSeptember 21, 2022

- Both Inflation and Inaction Are UnbiblicalSeptember 14, 2022

- Misunderstood in the NeighborhoodAugust 18, 2022

- Billy Graham was the inspiration for the new BiblegraphAugust 9, 2022

- A Businessman Who Really Did Give it All Over to God

Categories

Investing involves risk, including the potential loss of principal.

Before investing, carefully consider the fund’s investment objectives, risks, charges, and expenses of the investment company. This and other important information can be found in the fund’s prospectus. To obtain a copy, visit TIMOTHYPLAN.COM or call 800.846.7526. Read each prospectus carefully before investing.

Because the Timothy Plan Funds do not invest in excluded securities, the Funds may be riskier than other funds that invest in a broader array of securities. There are risks when a fund limits its investments to particular sized companies, and all companies are subject to market risk. The Fund recently experienced significant negative short-term performance due to market volatility associated with the Covid-19 pandemic.

MUTUAL FUND INVESTOR

To read more about our mutual funds, please click this link to access fund information, including the prospectus, fact sheets, performance, and holdings for each fund.A prospectus is available from the Fund or your financial professional that contains more complete, important information. Please read it carefully before investing. Mutual Funds distributed by Timothy Partners, Ltd. Member FINRA.

HEADQUARTERS: 1055 Maitland Center Commons, Maitland, FL

(800) 846-7526 | Send an email | View our mapMUTUAL FUND SHAREHOLDER SERVICES: c/o Ultimus Fund Solutions, Post Office Box 541150, Omaha, NE 68154-1150

(800) 662-0201 | Account AccessETF INVESTOR

To read more about our ETFs, please click this link to access fund information, including fact sheets, performance and holdings for each fund. A prospectus is available from the Fund or your financial professional that contains more complete, important information. Please read it carefully before investing. ETFs distributed by Foreside Fund Services, LLC, Member FINRA. Timothy Partners, Ltd. is not affiliated with Foreside Fund Services, LLC.

ETF SHAREHOLDER SERVICES: Contact your financial advisor for information regarding your account.

Macroeconomic Update

The U.S. economy continues to experience strong growth, with all economic models indicating that the Q3 Gross Domestic Product (GDP) growth rate will continue to be very strong. Specifically, the Atlanta Federal Reserve’s GDP model estimates Q3 growth at 4.1%, only modestly lower then Q2 GDP growth of 4.2%. Business confidence remained high and attempts to move product through the supply chain prior to implementation of tariff s propped up operating rates. Continued employment gains during Q3 and a further increase in average hourly earnings kept consumer confidence at elevated levels. When consumers feel confident they tend to keep their wallets open. Federal government spending, following the adoption in mid-March of a $1.3 trillion spending plan for the fiscal year ending September 30, 2018, also added to aggregate U.S. growth. That spending plan was temporarily extended to the end of 2018.

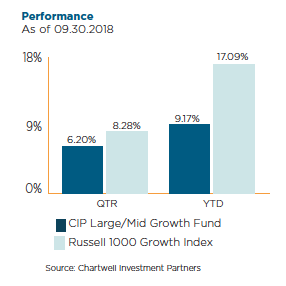

Q3 2018 Performance Update

The Timothy Large/Mid portfolio returned 6.2% in the third quarter versus a Russell 1000 Growth Index return of 9.2%. The Technology sector was a hard hit to the bottom line. Restricted stocks Apple and Microsoft put up double digit returns for the quarter and Western Digital, Micron and IPG Photonics all underperformed significantly. This combination “cost” the fund 250 basis points. Stock selection in Consumer Discretionary and Consumer Staples was strong with picks like Lowes (+21%), O’Reilly Automotive (+14%) and McKesson (+14%) but these didn’t compensate for the Technology pitfalls. While growth did outperform value this quarter, large growth also beat small growth names. This environment can be a headwind for our portfolio as we reach into lower capitalizations to replace larger restricted names.

Contributors

Lowe’s (LOW, + 20.7%; average position size 4.0%) is a home improvement retailer. The company had a very solid quarter, with earnings up 32% and same store-sales growth of 5.2%, a nice acceleration from the prior quarter’s +0.6%. The Street also liked the actions taken by the newly-hired CEO (former Home Depot head of U.S. stores). Following a strategic assessment of the “Orchard Supply” hardware banner, he decided to shutter all 99 stores. Additionally, the hiring of a new CFO was announced. Another top overall contributor on a relative basis was Insulet Corporation (3.3%), which returned 23.6% during the quarter. Insulet is a device company that is benefitting from the accelerating adoption of pump systems by diabetics on a global scale. They are also modifying their distribution structure, moving to direct sales in Europe, which should lead to higher operating margins over the next year.

Detractors

Western Digital (WDC, – 23.7%, average position size 1.7%) is a maker of data storage devices and solutions. The company had a good earnings report, but guidance was disappointing and led some to fear that the “NAND” (computer memory) cycle might be turning. NAND prices fell mid-to-high single digits in the quarter, driven by strong supply growth and weaker than expected mobility demand. The better news was that WDC continues to see robust demand for its high capacity enterprise hard disk drives.

Micron Technology (MU, – 13.8%, average position size 1.7%) engages in the provision of innovative memory and storage solutions. Its specialty is DRAM (dynamic random access memory). While MU reported EPS for 4Q that surprised even the highest sell-side estimate and grew earnings 75% y/y, by far its highest EPS number ever, it guided for a significant drop-off in 1Q. While almost all sell-side models already reflect this, the additional commentary around PC concerns and China tariff exposure gave bears the excuse they needed to punish the stock. This, combined with the raised capex guidance, off set the strong beat and positive buyback update.

Market Outlook

Despite ongoing wrangling over tariff s and trade, the market seemed to take its cue from very strong earnings, powering all three U.S. market indices (S&P500, DJIA, and NASDAQ) to new highs as we closed out the third quarter. Post the tax-law changes, S&P500 earnings have climbed 22-25% for the first half of 2018, and revenue growth as also been very impressive, up 9-10%. Small stocks had a strong Q2, but Q3 saw the advantage go back to large. This was likely due at least in part to some settling down of trade-war concerns (which at their peak, had favored smaller, domestically focused companies). What has remained nearly unrelenting this year and last quarter has been the remarkable outperformance of growth stocks over value: Russell 1000Growth Index +17.1% vs. Russell 1000 Value Index +3.9% year-to-date and Russell 1000 Growth Index +9.2% vs. Russell 1000 Value Index +5.7% for Q3. As we move toward 2019, the heightened pace of both economic growth and earnings growth that we have enjoyed will be hard to maintain, possibly presenting challenges for the stock market.

Manager views expressed herein were current as of the date indicated above and are subject to change. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this commentary. A copy of the calculation methodology and the full list of recommendations made in the preceding year is available upon request. The performance data quoted represents past performance and does not guarantee future results. Performance returns quoted are gross of fees which were calculated on a time weighted basis and do not give effect to investment advisory fees, which would reduce such returns. Please see Chartwell’s Form ADV, Part II for a complete description of investment advisory fees. The following statement demonstrates the compound effect advisory fees have on investment returns: For example, if a portfolio’s annual rate of return is 15% for 5 years and the annual advisory fee for a client is 100 basis points or 1.00%, the gross cumulative 5 year return would be 101.1% and the five year return net of fees would be 92.5%. Actual fees charged to portfolios may be different due to various conditions including account size, calculation method and frequency, and the presence of a performance or incentive fee. The deduction of performance and incentive based fees will have similar, yet often larger, impacts to performance and account values than standard management fees. To receive a complete list and description of Chartwell Investment Partners’ composites, performance attribution for all securities, and/or a presentation that adheres to the GIPS® standards, please contact Lynette Treible by phone (610)407-4870, email [email protected], or by mail to 1205 Westlakes Drive, Suite 100, Berwyn, PA 19312.